how to pay indiana state withholding tax

Tax Withholding For Pensions And Social Security Sensible Money. A Payment Confirmation page displays after the payment has been submitted successfully.

Opt Student Taxes Explained Filing Taxes On Opt 2022

Welcome to INtax.

. To register for withholding for Indiana the business must have an Employer Identification Number EIN from the federal government. Put some money back to ensure you are able to pay your taxes. Print this page for your records.

In addition the employer should look at Departmental Notice 1 that details the withholding rates for each of Indianas 92 counties. Expand All Collapse All. Indiana Withholding Tax Voucher.

Although these laws are repealed you must still file any past-due returns and pay taxes due to DOR. When completed correctly this form ensures that a businesss withholding taxes by county are reported accurately and timely. Register and file this tax online via INTIME.

Visit the Indiana Department of Workforce Development to learn more about filing for. Register and file this tax online via INTIME. County Rates Available Online.

All businesses in Indiana must file and pay their. You can also make your estimated tax payment online via INTIME at intimedoringov. Repeal of Utility Services Use Tax and Utility Receipts Tax.

INtax supports the following tax types. For Medicare tax withhold 145 of each employees taxable wages until they have earned 200000 in the 2022 tax year. Know when I will receive my tax refund.

Gasoline Use Tax GUT. Find out how to pay estimated tax. Register and file this tax online via INTIME.

Annual Withholding Tax Form. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Withholding payments must be made to DOR by the due dates or penalties and.

Indiana composite return instructions 2019. The WH-1 is the Indiana Withholding Tax Form and is required for any business that is withholding taxes from its employees. Indiana county resident and nonresident income tax rates are available via Department Notice 1.

Indiana repealed Utility Services Use and Utility Receipts taxes effective July 1 2022. Friday April 22 2022. Know when I will receive my tax refund.

If you are required to withhold federal taxes then you must also withhold Indiana state and county taxes. However if not completed correctly there is a. Indiana state withholding tax rate 2021.

For Social Security tax withhold 62 of each employees taxable wages until they have earned 147000 in the 2022 tax year. Once in the employee record Click the Payroll Info tab. Make a payment online with INTIME by electronic check bankACH - no fees or debitcredit card fees apply Make a payment in person at one of DORs district offices or downtown.

Find Indiana tax forms. This is where youll begin the INtax registration process. 10 of the unpaid tax liability or 5 whichever is greaterThis penalty is also imposed on payments which are required to be remitted electronically but are.

Find Indiana tax forms. You must also match this tax. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

For Medicare tax withhold. As an employer you must match this tax dollar-for-dollar. CocoDoc is the best spot for you to go offering you a great and easy to edit version of Payment Of Indiana Withholding Tax For Nonresident as you require.

The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME which currently offers the ability to manage most tax. Its huge collection of forms can save your time and jumpstart your efficiency massively. This site contains confidential and personally identifiable information.

How to pay indiana state withholding tax. The Indiana Department of Revenue DOR is transitioning tax accounts to its new online e-services portal INTIME to offer the ability to manage tax account. Underpayment of Indiana Withholding Filing.

A request should be sent that verifies the payment amounts for nonresident withholding that the payments be moved to the corporate account and that the WH-1s should be zeroed out. Indiana tax calculator is an easy tool for computing the amount of withholding tax on your salary income. Failure to pay tax.

INtax supports the following tax types. If you have not filed the return select File Return from the Payment.

How Do State And Local Individual Income Taxes Work Tax Policy Center

Can I Print My Own Payroll Checks On Blank Check Stock Welcome To 1099 Etc Com Payroll Checks Printing Software Writing Software

Lili S Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Solved Indiana Withholding Setup In Quickbooks Payroll

Indiana Estate Tax Everything You Need To Know Smartasset

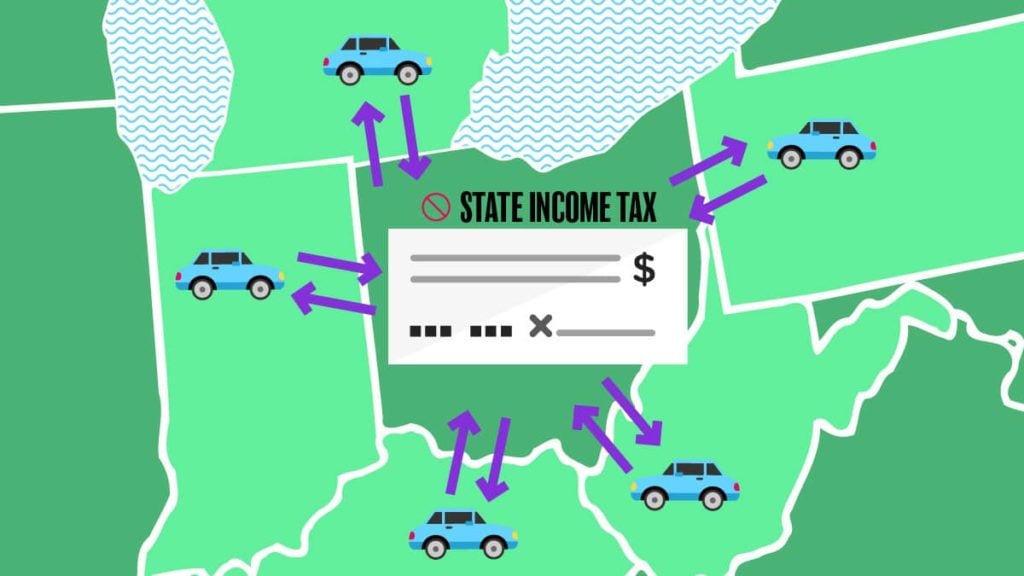

Reciprocal Agreements By State What Is Tax Reciprocity

Whitley Tax Service Logo And Print Design Print Design Service Logo Tax Services

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

B F Tax Management Resolution Home Facebook

Solved Indiana Withholding Setup In Quickbooks Payroll

Tax Registration Taxes Fees Inbiz

B F Tax Management Resolution Home Facebook

What Is Local Income Tax Types States With Local Income Tax More